what is tax planning and tax evasion

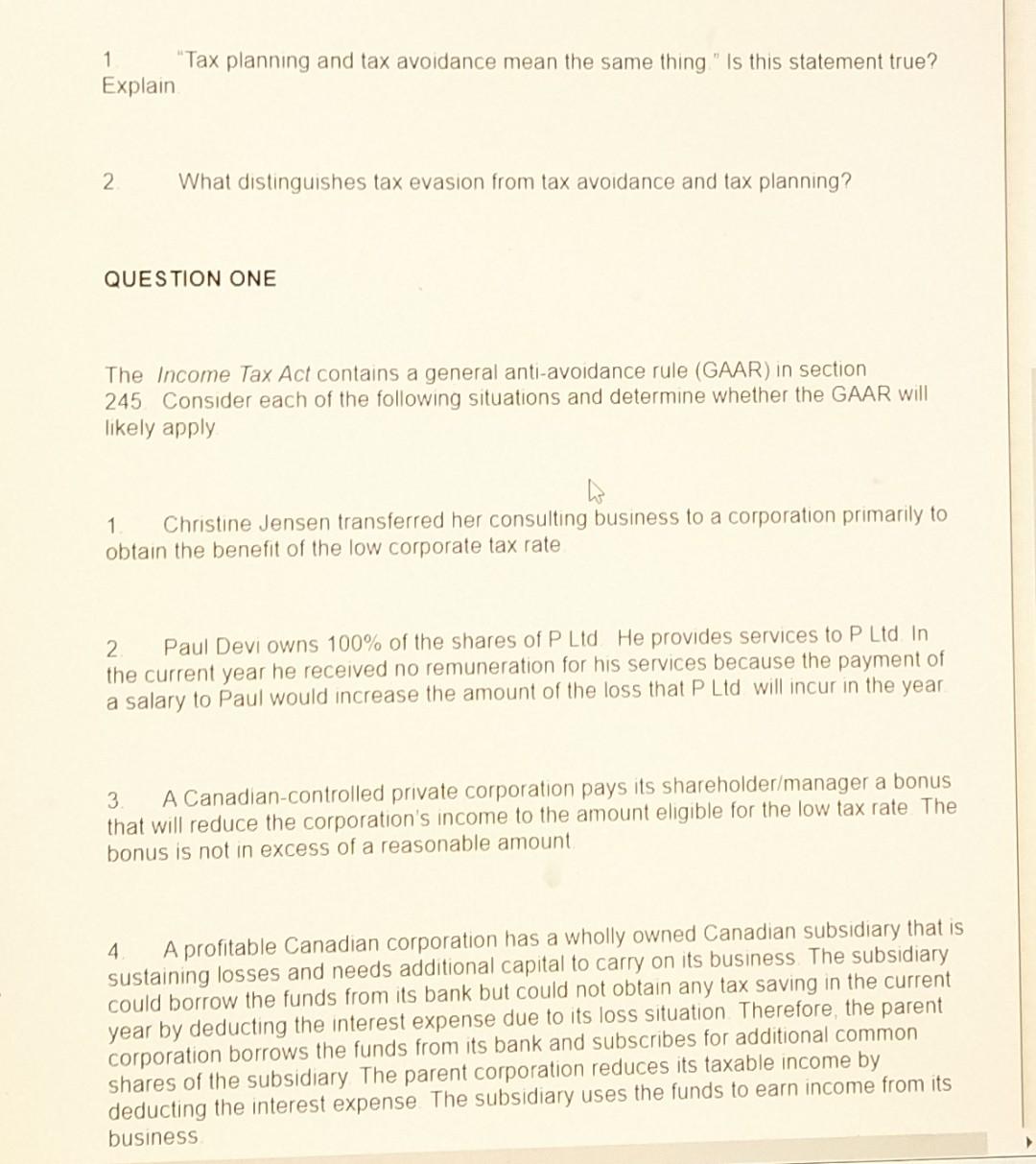

Keep in mind that theres a difference between tax planning and tax evasion. The penalties for tax evasion depend on the severity.

Tax Planning Tax Avoidance Tax Evasion In Hindi Part 2 Youtube

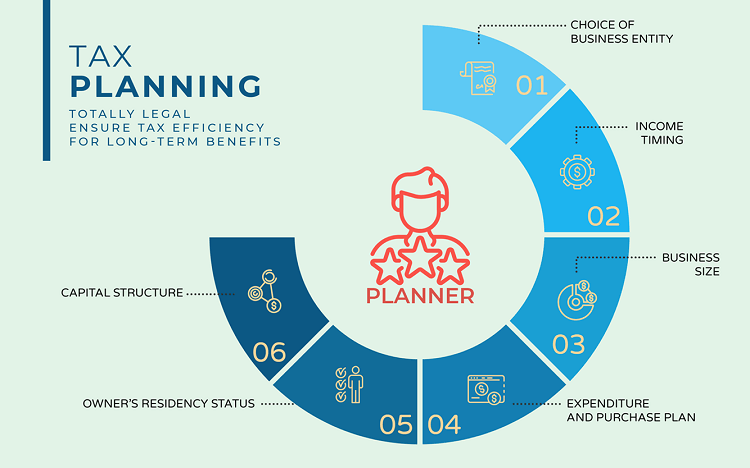

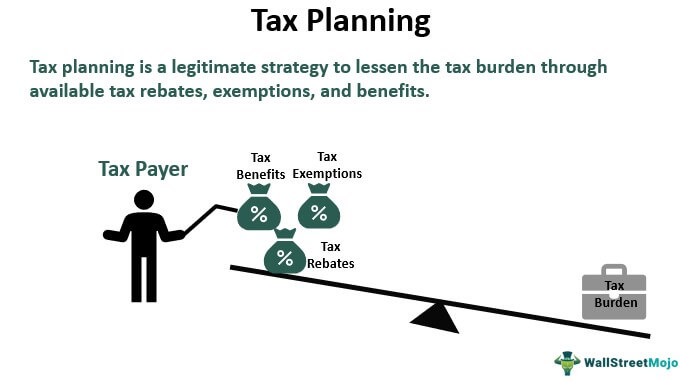

Tax planning is using legal strategies to lower your tax.

. Tax evasion is a federal crime that can result in substantial fines and even imprisonment. Lets understand it by example. Unlike tax avoidance tax evasion has criminal consequences and the individual may face prosecution in criminal court.

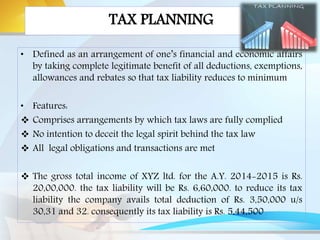

The consequences of tax evasion. Various methods of Tax Planning may be classified as follows. Income- Rs 100- Case 1.

Tax Planning is basically arranging ones financial affairs in such a way that benefit of all the eligible exemptions deductions allowances and concessions given under. There is a thin line of difference between the two but the consequences are far away from thin. What is Tax Planning.

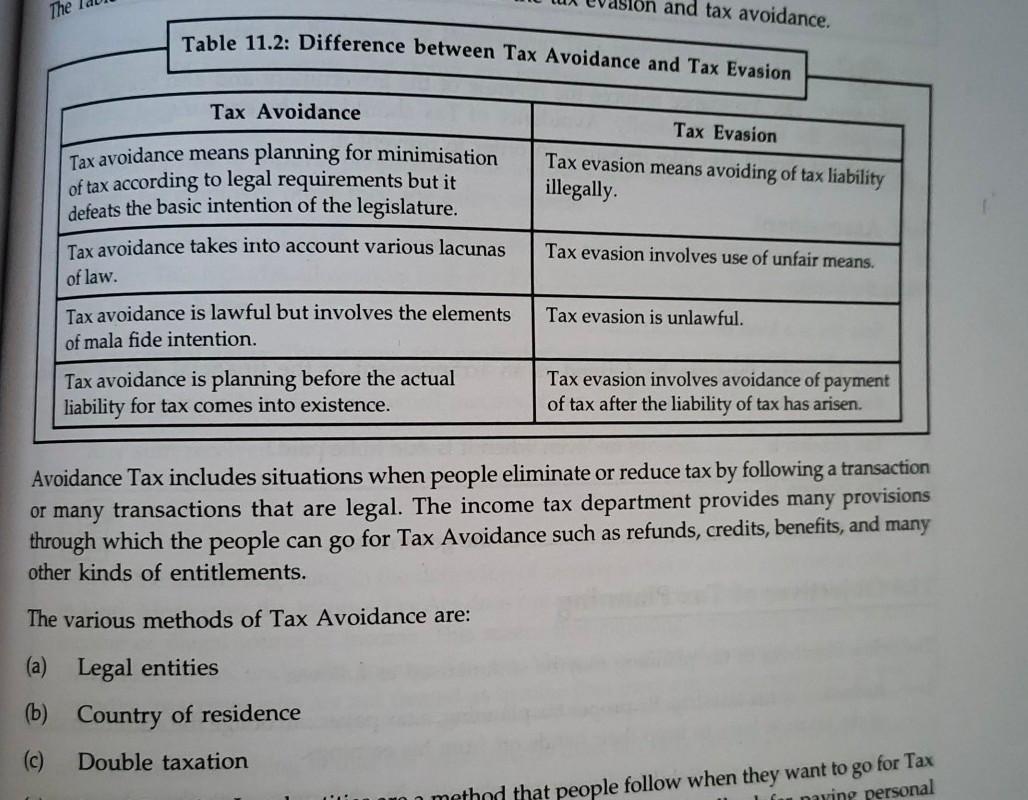

As considered as fraud tax evasion is an illegal method to reduce tax. In contrast Tax Planning takes maximum advantages of the exemptions deductions rebates reliefs and other tax concessions allowed by taxation statutes leading to. Short Term Tax Planning.

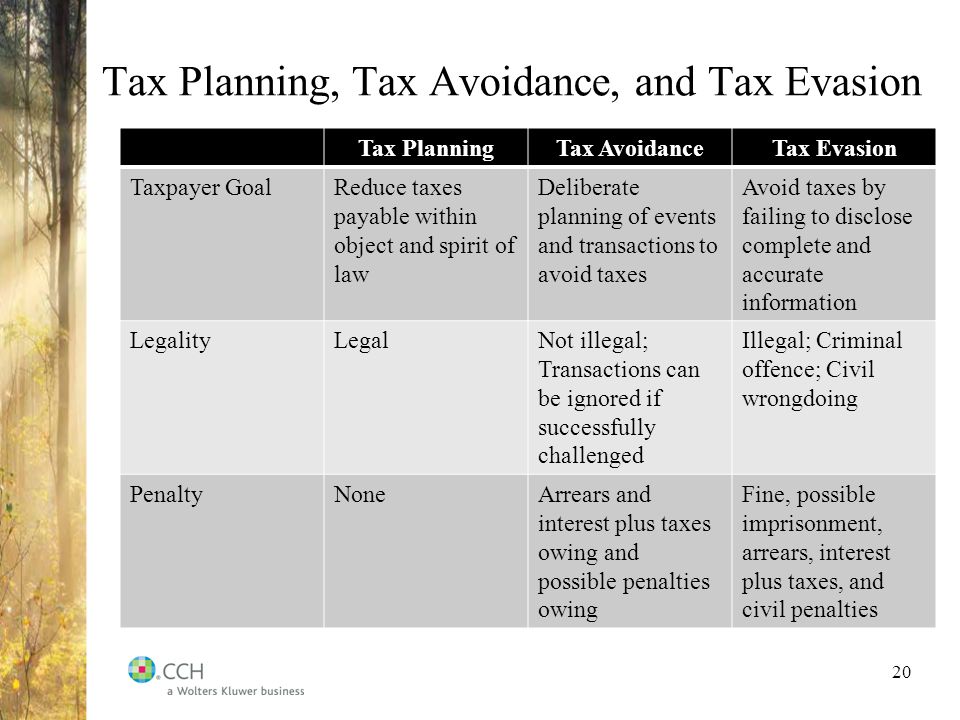

What Is Tax Planning vs. Answer 1 of 11. Although the objective of all the 3 ie tax planning tax avoidance and tax evasion is to reduce the taxes the method adopted by them is different.

For example Alex works at an. Tax Planning is the. Short range Tax Planning means the planning thought of and executed at the end of the.

Usually tax evasion involves hiding or misrepresenting income. Tax evasion on the other hand is using illegal means to avoid paying taxes. Tax evasion is considered a crime.

Statutory provisions are followed under tax planning while statutory provisions are violated under tax evasion. In other words tax planning is an art in which ones financial affairs are logically planned in such a way that the assessee benefits from all of the taxation laws eligible. Difference between Tax Planning and Tax Evasion.

Tax avoidance is performed by availing loopholes in the law but complying with law provisions. Answer 1 of 11.

Difference Between Tax Planning Pdf

Some Of The Best Methods To Prevent Tax Evasion Enterslice

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)

Tax Avoidance And Tax Evasion What Is The Difference

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Chapter 1 Introduction 1 Background And Introduction History And Legislation Canadian Tax System Brief History Of The Income Tax Act Constitutional Ppt Download

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

Tax Planning Tax Evasion Tax Avoidance

Tax Planning Tax Avoidance Tax Evasion Tax Planning Management Taxation Laws Income Tax Youtube

Tax Planning Meaning Strategies Objectives And Examples

Tax Planning Evasion And Avoidance

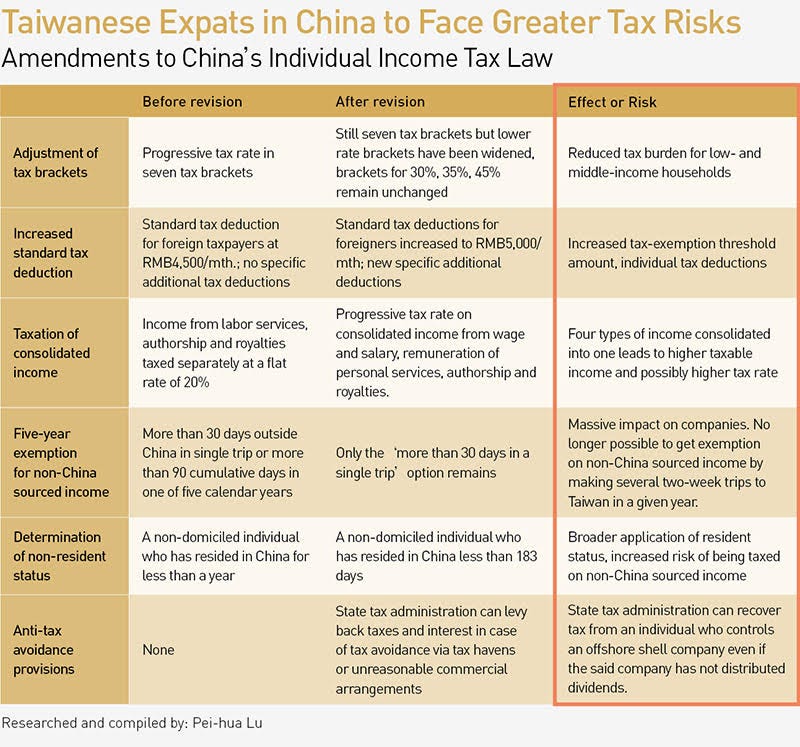

China Cracks Down On Tax Evasion Chasing Every Penny By Commonwealth Magazine Commonwealth X Crossing Medium

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Tax Avoidance And Tax Planning Three Conflict Tax Terms

Solved 1 Tax Planning And Tax Avoidance Mean The Same Thing Chegg Com

Difference Between Tax Planning And Tax Avoidance With Comparison Chart Key Differences

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Difference Between Tax Planning And Tax Evasion L Tax Evasion

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

What Are The Differences Between Tax Planning And Tax Avoidance